Research

I am an urban economist specializing in the relationship between housing prices, rents, and their spatial distribution. My research focuses on the role of geography in shaping key dynamics of the housing market. I use granular data and state-of-the-art empirical identification strategies, combined with quantitative spatial models, to better understand the geographic behavior of households and its implications for the macroeconomy and public policy. More broadly, I am interested in how the spatial distribution of economic agents and their choices shape economic outcomes and interact with government policies.

Working Papers

Mortgage Rates and the Price-to-Rent Ratio Across Space. (JMP)

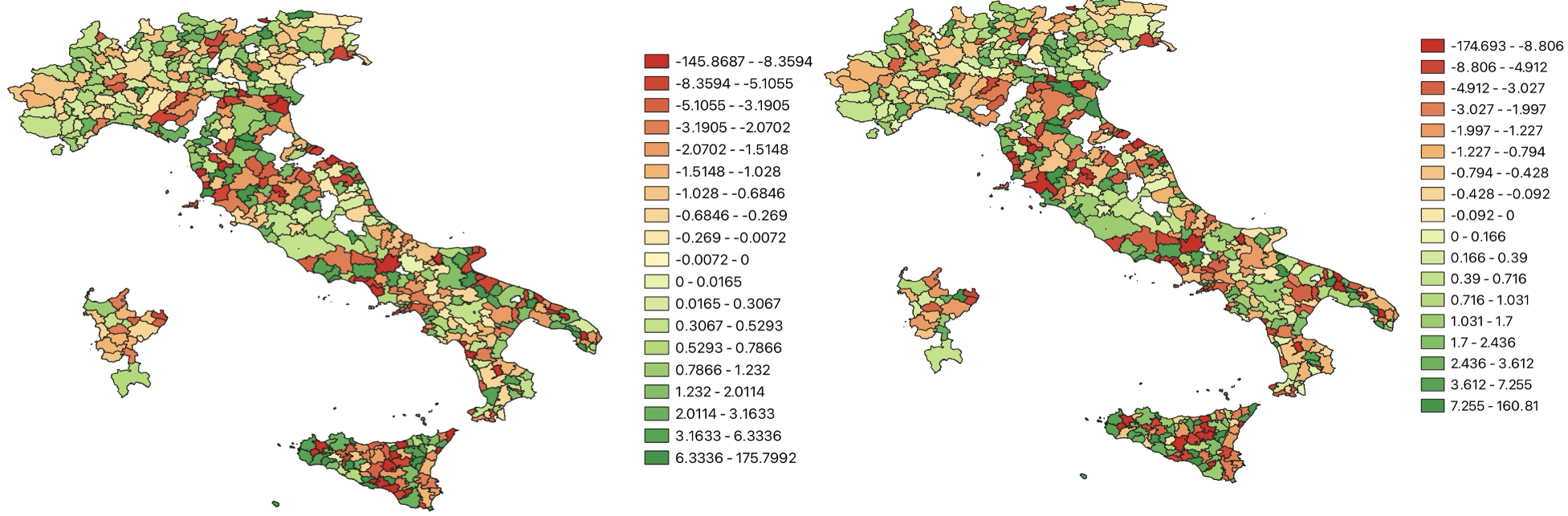

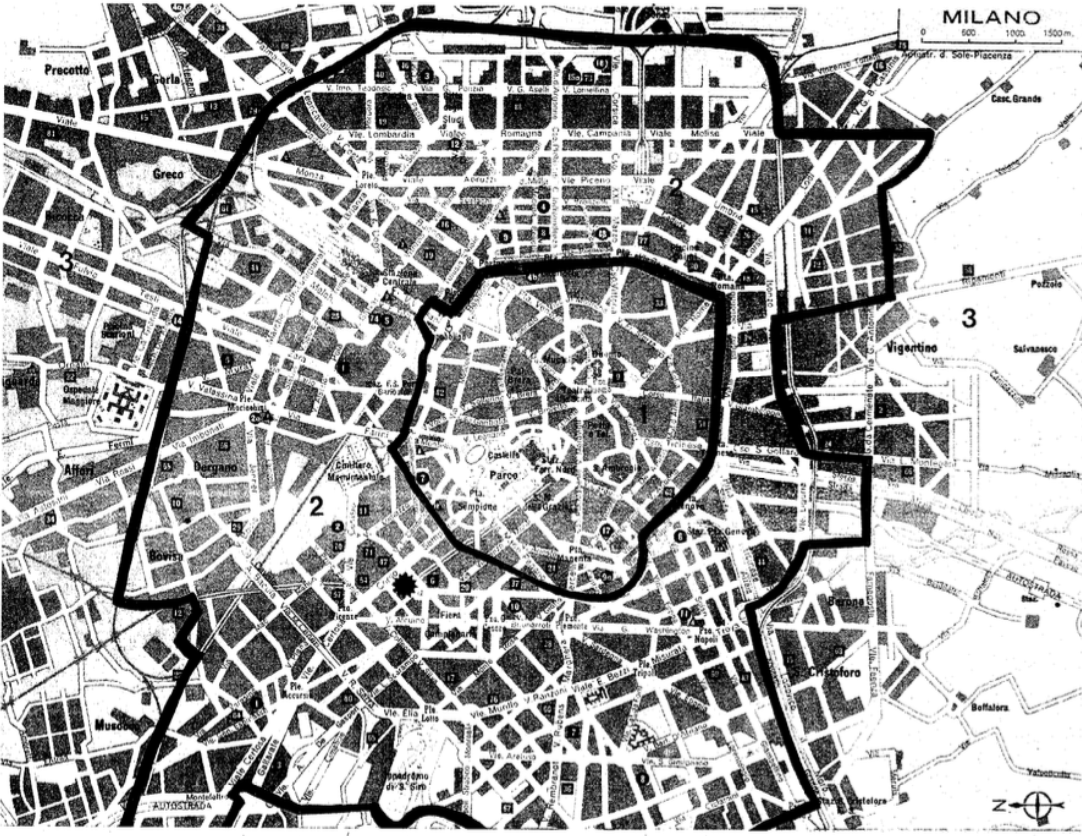

This paper develops a parsimonious housing market model that conceptualizes residential real estate as both a non-tradable consumption good and an investment asset. The framework embeds households’ joint location–tenure choices, which shape local price-to-rent ratios. I test its predictions using a granular dataset of Italian housing prices and rents and a shift-share instrumental variable design exploiting heterogeneity in mortgage uptake across age groups. The results show that mortgage rate shocks induce spatially asymmetric responses in prices, rents, price-to-rent ratios, population, and tenure choices, consistent with the implications of the model. A structural estimation reproduces these heterogeneous effects and indicates that a positive mortgage rate shock alleviates spatial welfare inequality and narrows the divide between renters and homeowners.

JEL codes: E22, G12, G21, R21, R23, R31

Presented:

- 13th European Meeting of the Urban Economics Association (preliminary version titled: “Geography in a Partially Segmented Housing Market”).

- 1st Zurich-Oxford Doctoral Symposium on Real Estate Markets.

- 2025 Econometric Society European Winter Meeting.

Work in progress

Property Taxation and Real Estate Price Dispersion.

I test the claim that property taxes reduce the price dispersion across properties of different quality thus reducing wealth inequality. I exploit the removal of the Italian property tax on main residences and its design to identify the effect of such tax on property prices. The results are consistent with the previous claims but heterogeneous in magnitude across different property markets. Additionally, I design a monocentric city model to connect the real estate asset literature with the urban economics one, and I find that the former has been ignoring two channels for the property tax to affect prices: the ability of households to switch between properties of different quality and its effect on the local consumption good bundle price.

JEL codes: G12, H24, R21, R31, R38

Media

In Italia la casa è un problema locale (In Italian).

Non siamo inglesi: da noi il caro-casa non riguarda tutto il paese, ma solo alcune zone ben precise. I dati dei contratti registrati al catasto mostrano che aumenti dei prezzi superiori all’inflazione interessano infatti un numero esiguo di comuni. C’è però un problema reale: costo e canoni delle abitazioni salgono proprio nei luoghi che offrono più opportunità di lavoro e di studio. Sono le aree del Nord e del Nord-Est verso le quali si trasferiscono molte persone, che spesso preferirebbero affittare un alloggio e non comprarlo. Le azioni che il governo intende intraprendere in questo campo devono tener conto della geografia dei rincari del mercato immobiliare. Altrimenti c’è il rischio di aggravare la situazione, invece di migliorarla.

Nasi, A. (2025, October). In Italia la casa è un problema locale. Rivista Eco, 10, 36-40.